for member with code GJ/AHD/12345/123 Emp no will be 123. Column 1 (Employee No) is numeric only and should not contain Establishment code i.e.Check if member is leaving withing same month of joining then the date of leaving should be greater than or equal to date of joining.Date should be of format dd/mm/yyyy strictly.The reason should be any one of following character ( C / S / R / D / P ). Only if the member has left the service in current month (of which you are generating ECR file), fill details of Form-10 (Date of leaving, Reason of leaving) else leave blank.The Relationship should be any one of following character ( F / S). Only if the member has joined in current month (of which you are generating ECR file), fill details of Form-5 (Father's/Husband name,Date of Birth, Gender, Date of joining) else leave it blank.The text file should not have header row, only data is required in text file.This is a delimited file not a fixed width file, which means all the fields(columns) are separated by some delimiter which in this case is #~# and you don't need to fill spaces or zeros.

The text file should strictly have 25 Fields.Please go through with it.Ī few things to keep in mind while preparing ECR text files are:

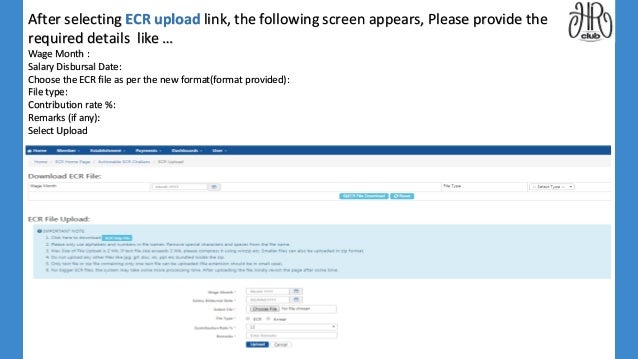

Section 142 provides for establishing the identity of an employee or an unorganised worker or any other person through Aadhaar number for seeking benefits and availing services under the Code.To generated ECR with Excel and Notepad there is a very good screencast made available on EPFO India website, which neatly explains how to generated ECR file for upload to E-sewa.

the central government hereby appoints the 3rd day of May 2021 as the date on which the provisions of section 142 of the said Social Security Code shall come into force," the notification had said. The Code was cleared by Parliament in 2020. According to the notification, the ministry and bodies working under it sought Aadhaar number from the beneficiaries under the Social Security Code. The EPFO had made Aadhaar seeding compulsory after a labour ministry issued a notification on May 3. This will give more time to employers to link their employee's Aadhaar number with PF accounts or UAN. However, the date of implementation for filing ECR (electronic challan cum receipt or PF return) with Aadhaar verified UANs has been extended to September 1, 2021, according to the new order. Besides this, the EPF account holder won't be able to avail of the EPFO services for EPF account holders. It meant that if an EPF account is not linked to the account holder's Aadhaar number, then the employer's contribution won't get credited to such an EPF account.

0 kommentar(er)

0 kommentar(er)